Balance Transfer Loan

Balance Transfer Loan

Transferring existing Personal loan from one financial institution to another financial institution is called personal loan balance transfer.

Transferring the current principal outstanding amount can be Bank to a bank, bank to NBFC, NBFC to a Bank, or NBFC to NBFC (Non-Banking Financial Corporation).

Documents Required for Balance Transfer Loan

Documents Required for Balance Transfer Loan

- Passport Size Photo

- Pan Card Copy

- Current Address Proof

- Experience Letter

- Recent 3 month Pay slip.

- Loan Statement or Loan Repayment Track or Loan Repayment schedule.

- Recent 6 month Emi Debiting Bank Statement

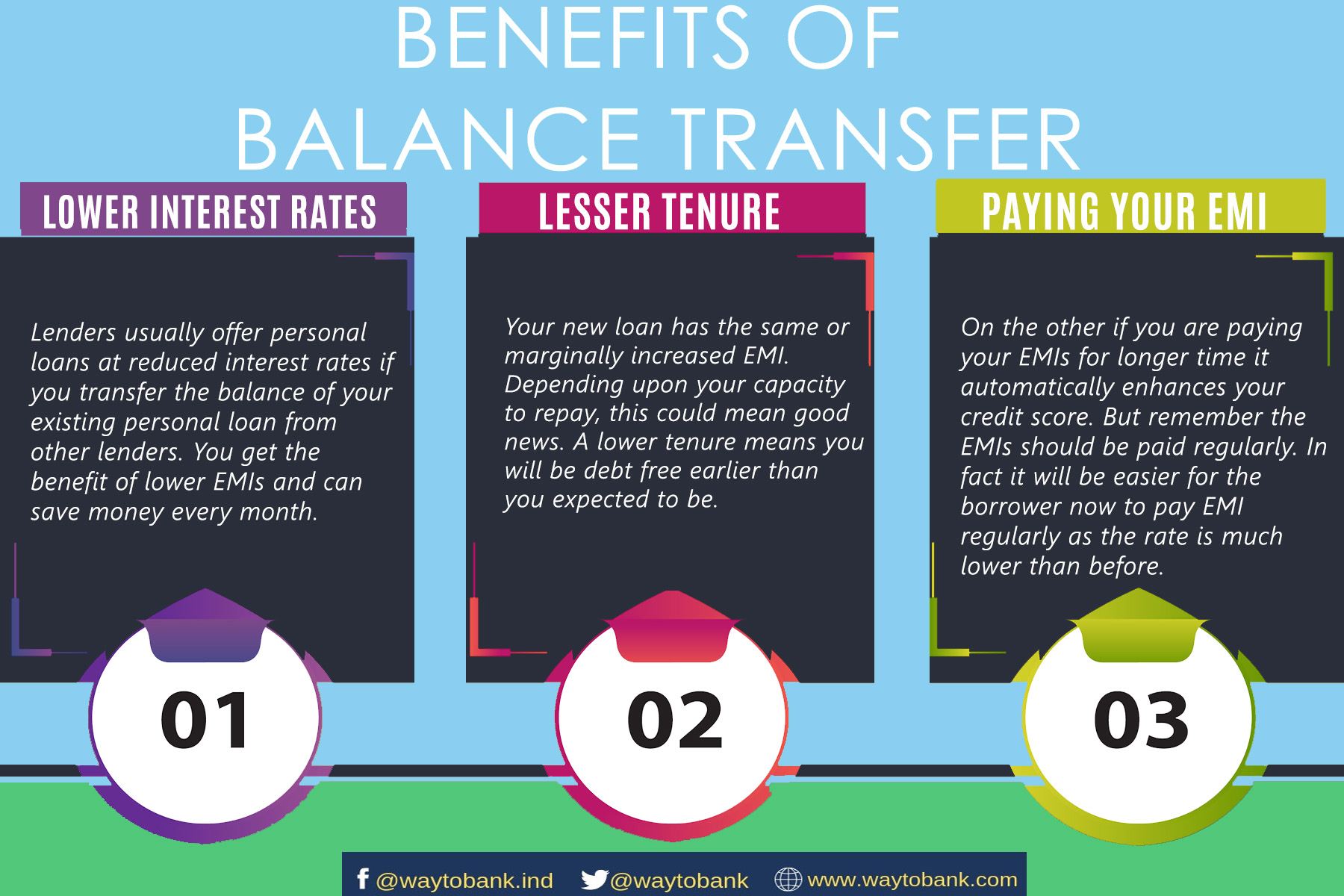

Advantages of personal loan Balance Transfer

Advantages of personal loan Balance Transfer

Personal Loan Balance Transfer can. Reduce the Rate of interest on your Existing personal loan.

for example if the running interest rate is 14% and already paid six-month EMI so you can transfer the personal loan to another bank for less interest rate up to 11.29%. However, it differs from bank to bank.

You can avail top-up Personal loan with Same interest rate on your Existing Loan with New Bank

Balance transfer reduces tenure on the existing personal loan. for example, the Personal loan tenure of five years can be reduced as much as possible after transferring the personal loan from one bank to the other.

Transfer of Personal Loan Can increase.your personal loan eligibility, for example, let assume, currently, you are running the personal loan of 10 lakhs for 5 years and you have already paid 4 years, approximately your principal amount will be 1 lakh and you have applied for one more personal loan. If you are facing any eligibility issues, you can increase the eligibility by doing the balance transfer.

Combine all Personal Loans into single EMI by merging multiple personal loans into one by doing the personal loan balance transfer.

5-Things to Consider Before Availing Personal Loan Balance Transfer

5-Things to Consider Before Availing Personal Loan Balance Transfer

Compare your current interest Rate With Balance transfer interest rate do not go if the ROI is Higher.

Consider to check preclosure charges on existing personal loan.

While doing Balance transfer Check BT Loan Charges.

Ask the bank about processing fee Charges

Reduce the tenure of your personal loan Balance Transfer.

5-Things to Consider Before Availing Personal Loan Balance Transfer

5-Things to Consider Before Availing Personal Loan Balance Transfer